child tax portal update dependents

If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you. The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child tax credit payments to update their income.

The Child Tax Credit Toolkit The White House

The IRS will make a one-time payment of.

. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. To add or change your bank you can do so through the Child Tax Credit Update Portal. To update your address with IRS.

Office of Governor Ned Lamont. Families should enter changes by November 29 so the changes are reflected in the December payment. Here is some important information to understand about this years Child Tax Credit.

Theres a Child Tax Credit Eligibility Assistant tool and a child Tax Credit Update Portal. That means that instead of receiving monthly payments of say 300 for your 4-year. The IRS will pay 3600 per child to parents of young children up to age five.

To reconcile advance payments on your 2021 return. It also lets recipients view. Enter your information on Schedule 8812 Form.

By fall people will be able to use the tool to update changes to family status and income. Soon people will be able update their mailing address. Child Tax Credit Update Portal.

The advance is 50 of your child tax credit with the rest claimed on next years return. Child Tax Credit Update Portal. The 2022 Connecticut Child Tax Rebate was created as part of the fiscal year 2023 budget adjustment bill that was signed into law by Governor Lamont.

It says on the IRS website that the first payment will be based upon the dependents you put on your 2019 2020 tax return. That drops to 3000 for each child ages six through 17. Check your eligibility and direct deposit information.

Child Tax Credit NEW portal. More information is on the Advance Child Tax Credit Payments in 2021 page of IRSgov. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. These two tools follow the Non-Filer Sign-Up Tool launched earlier this month. Half of the money will come as six monthly payments and.

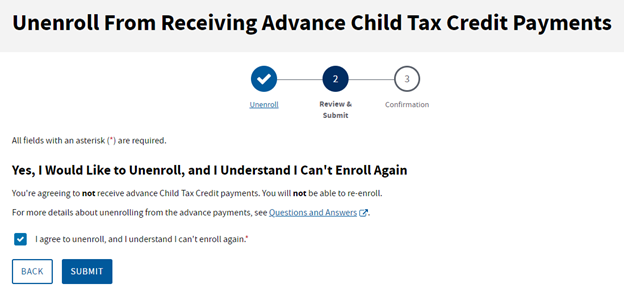

You can unenroll by contacting the IRS at the phone number on your Advance Child. The IRS will add more features to the Child Tax Credit Update Portal through the summer and fall. June 28 2021 The Child Tax Credit Update Portal allows you to verify your eligibility for the payments.

You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. The total changes to 3000 per child for parents of six to 17 year olds or 250 per month and 1500 at tax time. At some point the portal will be updated to allow you to update how many dependants you have.

Other features coming to the portal include changing ones income and dependents. The Child Tax Credit Update Portal allows users to make sure they are registered to receive advance. You will be able to see if your eligible for advance payments.

In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly. See Q F3 at the following link on the IRS web site. Get your advance payments total and number of qualifying children in your online account.

The Update Portal for adding a dependent is not available yet. To access this portal users need an IRS username or an IDme account. To check your eligibility refer to the Eligibility section on the main page of the Child Tax Credit Update Portal.

The Child Tax Credit Update Portal lets you verify that your family. The updated information will apply to the August payment and those. The IRS is paying 3600 total per child to parents of children up to five years of age.

That budget includes more than 600 million in tax cuts amounting to the largest tax reduction in Connecticuts history. Child Tax Credit Update Portal. COVID Tax Tip 2021-167 November 10 2021.

Parents who claimed their dependents on. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. Heres how they help parents with eligible dependents.

The Child Tax Credit provides money to support American families. The IRS says it will be available later this year If you dont get all the payments for your new child during the year you will be able to claim the missing amount as a credit on your 2021 tax return. In the first box.

This tool can be used to review your records for advance payments of the 2021 Child Tax Credit.

![]()

Child Tax Credit Update Irs Launches Two Online Portals

2021 Child Tax Credit Advanced Payment Option Tas

Did Your Advance Child Tax Credit Payment End Or Change Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Child Tax Credits 2021 What To Do If You Don T Get Your Payment Today

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

Child Tax Credit Update Irs Launches Two Online Portals

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

Arpa Expands Tax Credits For Families

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

No Lines No Waiting You Don T Have To Wait For The Irs Refund At The End Of February Get An Advance Up To 3000 Wh Filing Taxes Accounting Services Tax Time

Tas Tax Tip Ten Things To Know About Advance Child Tax Credit Payments Taxpayer Advocate Service